All over the world, there is increasing need to improve revenue collection that comes through tax, however, experts agree that in doing this, tax authorities must be humane in their approach to collection, if it is to yield the desired result. BENJAMIN UMUTEME writes.

In the aftermath of Covid-19 and its socioeconomic impact, rising inflation and rising interest rates, the Ukraine-Russian war, Nigeria’s ever-increasing public debt, vagaries of nature brought about by global warming and climate change as well as the continuous outflow of illicit financial flows from Africa, it is obvious that authorities need to look for new mean of financing its ever increasing obligations to its citizenry.

What has become obvious is that oil revenue can no longer fund Nigeria’s budget and the quest by the government to close its massive infrastructure gap which experts say would take a whooping 30 years with the government spending in the region of N30 billion.

And increasing, governments around the world are now turning to tax as a means of domestic revenue mobilisation.

And Nigeria cannot be left behind in the quest to make use of its option B, as option A, which is oil revenue, is on the downward drive especially with the level of oil theft and pipeline vandalisation taking place in the country.

Administering tax with human face

Over the years, the need for tax administrators to be humane in their approach to tax collection and the various policies continue to dominate discourse at different forums. And this was no different when the 41 member African Tax Administration Forum (ATAF), gathered in Lagos, Nigeria.

The 7th ATAF General Assembly which had as its theme: “Rethinking Revenue Strategies: The Human Face of Taxation’, focused on the need for tax administrators to be humane in their dealing with the citizenry.

In a clarion call to ATAF members, FIRS Executive Secretary, Muhammed Nami, said governments across the continent must begin to rethink governance, engender public confidence and trust in government by providing value for taxpayers’ money in line with their obligations under the social contract they have with citizens.

“The Fiscal social contract which hinges on the willingness of the citizens to pay tax in return for the provision of public service, is a clarion call on the government at all levels in Africa to rethink governance.

“In my view, if we must transform the tax system and enhance revenue collection in Africa, there is a need for governance at all levels to engender public confidence and trust in government by providing value for taxpayers’ money,” Nami said.

Nami also stated that governments should reconsider how projects are reported in the public space, with such reports communicating to convey the idea that taxpayers’ money is used to fund infrastructure projects.

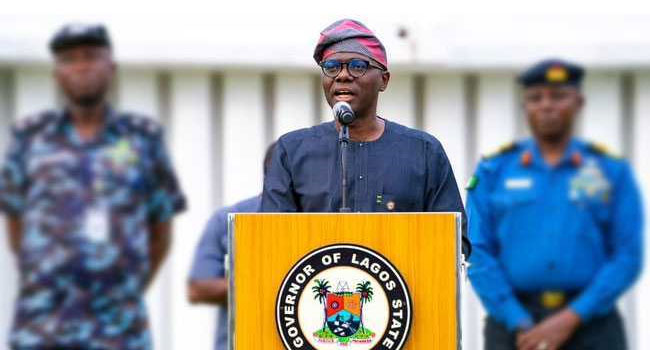

And Lagos State Governor, Babjide Sanwo-Olu, could not agree less when he said there was need to give taxation a human face, by implementing projects with taxpayers’ money that impact the lives of the citizens.

According to the Governor, there is no development without funding.

“We have, amongst others, embarked on major transformational infrastructure projects cutting across transport, health, education, agriculture, technology amongst others.

“These major infrastructural interventions are designed to improve the quality of life of our citizens and re-engineer economic growth and development trajectory with improved productivity of our citizenry, which invariably improves our tax generating abilities.

“In a bid to save the human face of taxation, communication and feedback from the taxpayer is of paramount importance,” he said.

In the same vein, ATAF’s Executive Secretary, Mr. Logan Wort, pointed out that a continent that can mobilise its resources for the improvement of the quality of lives of the people is one with adequate socio economic infrastructure, good educational institutions, quality healthcare, strong institutions, good governance, peace and generally a good standard of living.

“While we consider strategies or frameworks within which to enhance domestic resource mobilization on the continent, we must always put into perspective its primary objective—being the impact on people’s lives as reflected by ATAF’s mandate in the new decade which is to serve the higher purpose of enabling and assisting African governments to mobilize their own domestic resources through taxation in order to build states that foster economic growth and social development in the interest and well being of all their citizens,” he said.

Social contract

One thing experts have agreed on is that tax revenues are not being used judiciously across the continent.

However, in Nigeria, the case is not about collection but rather it is about getting a larger percentage of businesses that are supposed to pay taxes into the tax net.

With a large portion of business in the informal sector, tax revenue collection continues to be challenging.

Increasing use of technology has shown that authorities need to design new ways to collect taxes. And the forward looking has responded with the introduction of its flagship tool the TaxPro Max, which has improved tax collection in Nigeria significantly.

Experts have asserted that there is need to improve conditions for domestic resource mobilization through a social contract between the government and the public through improved public services to reinforce accountability and transparency, and in the process, build public trust. This also brings t the fore the need to prioritise the effective use of resources in a manner that the public can feel the positive impact of the sustainable development projects funded by tax revenues. This will go a long way to sustain confidence and belief in the social contract, and improve tax compliance with the multiplier effect of making revenue available for development financing.

In a chat with Blueprint, development economist Adefolarin Olamilekan, said the FIRS Executive Chairman, Muhammed Nami, was spot on, especially from the standpoint of the need for tax administrators to strike a balance between, tax laws, tax collection, and usage of tax revenue.

He said: “What may have informed the FIRS boss who also doubles as chair of African Tax Administration Forum (ATAF) can’t be far from the established fact of dwindling global economy as a challenge that is putting pressure on taxpayers. This alone has created a big gap in tax revenue that is supposed to accrue to the government and also reduce the impact of governance on the development path. More so, this has discouraged many taxpayers particularly, as the conducive business environment since the end of COVID-19 is yet to recover fully.

Nevertheless, tax governance and administration is indeed urgently needed a rethinking that would create a balance of tax law, collection and usage. In this way, tax payers are eager to see and partake in the use of tax revenue.”

Going forward, Olamilekan noted that governments across board must see tax as a social contract that resonate value addition to citizens through development and development of infrastructure. This is the only way tax payers can be encouraged to fulfill their obligation to the state.

“However, tax administration and its governance must, recognize the important roles tax play in social cohesion and integration in the country. Therefore, tax must be seen as a means to engender collective development agenda. Consequently, tax collection requires strategic tax governance approach that must embrace transparency, accountability and value orientation.

“Furthermore, we believe tax governance and administration of tax must avoid excesses such as multiple tax features. This alone is crippling businesses and venture. In this wise, a centralize and flexible tax approach would be better as this again will help ensure the human face to tax governance.

“Lastly, use and adoption of less complex and affordable technology would go a long way in tax governance and a better tax payer’s collection,” he said.