Benefits Assurance Plc has assured its shareholders that it would meet the required capital base before the June 2020 recapitalisation deadline set up by the National Insurance Commission (NAICOM).

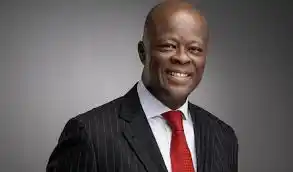

The Chairman, Dr. Akin Ogunbiyi, who gave the assurance at the company’s yearly general meeting in Lagos, said resolutions have been proposed to increase the authorised share capital from N10 billion to N15 billion and also to authorise the directors to raise additional capital to ensure that the company and its life subsidiary meet the requirement.

He said the company recorded a net underwriting income of N13.9 billion for the year ended 31 December 2018.

This represents a 19 per cent increase from the N11.77 billion recorded in 2017 for the Group, while the gross premium is written also grew by 13 per cent from N14.03 billion in 2017 to N15.84 billion in the year under review.

Net premium income stood at N13.47 billion, representing an 18 per cent increase from N11.46 billion in 2017, while profit after income tax stood at N1.149 billion; a 12 per cent increase from 2017 figure of N1.02 billion.

The 70 per cent increase in claims paid over the 2017 figures impacted the company’s underwriting profit, which dipped by 17 per cent to N3.05 billion.

The company paid claims amounting to N3billion in the period under review, with motor claims being the highest, amounting to N1.10 billion, followed by fire, which was N664 million, General Accident N330 million, while Aviation risks attracted N441.90 million.

Claims paid on other classes of business include Engineering N166 million; Oil and Gas risks N108.90 million and Marine N241.60 million.

“The claims paid shows the commitment to meeting the obligations of the customers. as the firm put in place systems and processes to ensure efficient claims service delivery.

“We are committed to prompt settlement of all genuine claims, as this aligns with our mission statement of transcending the expectations of our customers for the satisfaction of their wealth protection needs through the provision of qualitative insurance and risk management services thereby creating values for all stakeholders,”