At last, the embarrassment caused by online loan providers to their embattled customers is coming to an end as the regulating authorities have woken up to the task; ELEOJO IDACHABA writes.

Some call them loan shark companies, others call them sharp online loans, but whatever appellation one gives to them, experiences have shown that they have left a sour taste in the mouths of many Nigerians judging from experiences. For instance, in January 2021, one Pastor Tony Oloche needed money so badly to sort out some needs for his family, but help was not forthcoming after reaching out to the people he knew. Suddenly, he realised that on several occasions, his Samsung android phone had propped up a message about quick loans that he can get in less than 30 minutes. Although, he never gave in to such before, because of the desperation to solve his immediate problem, he asked someone to guide him to apply online and in less than two hours his account was credited with N5, 000 as against N15, 000 that he requested for.

Although disappointed, it was for him better than nothing. There was, however, a condition that he was to repay the money within three months and that for each month, he was to pay an interest fee of 10 per cent on the capital. His initial problem was that there was no designated bank to which he would pay in the monthly interest or the capital except through another portal sent to him by the loan agency. Each time he logged into that site with the intention to pay, either the site is not active or he finds it difficult to log in. He was subsequently directed to the United Bank of Africa where they claimed the repayment could be done, but the bank branch located on Gana Street in Maitama Abuja could not understand the process. This continued for almost six months until he began to receive text messages and phone calls from an agent of the loans firm with instructions on how to repay.

“All these, however, never worked and the loan firm has no known office where one can walk into in order to repay loans,” he said. Narrating further to this reporter, he said, “The next thing they did was to trace all my contacts and forwarded a message to some of them intimating them that I am a criminal who is known for borrowing money, but failing to repay; therefore, they should avoid me like a plague. I was devastated. I never knew they went that far until a fellow pastor who got the message forwarded it to me. I was shocked. I have made countless efforts to repay, but all the attempts failed. How can I run away with N5, 000? Even if the accruing interest amounts to another N5, 000, how would I run away because of that amount?”

This experience is not only peculiar to Oloche as in recent times, due to the biting economic situation in the country and the inability to meet the requirements of banks, many people resort to borrowing from such online loan firms in order to meet one obligation or another even as the outcome in most cases is not palatable. The outcry in recent times has been overwhelming to the point that some lawmakers recently moved a motion to investigate the activities of such firms. This is just before the National Information Technology Development Agency (NITDA) came up with a policy statement in that wise last week.

NITDA’s move

To that extent, NITDA stated that it had begun investigation into the activities of online banks, especially loan providers, over alleged breach of customers’ privacy and data.

According to the director-general of the agency, Kashifu Inuwa, many Nigerians had recently lamented on the social media over alleged unethical and dehumanising conducts of e-commerce platforms who offer short term loans.

NITDA noted with dismay that because banks in the country preferred to lend to businesses and not individuals, new companies with fictitious names have filled the gap by offering quick loans through smart phone apps.

Startups like Carbon, Branch, and Fairmoney started as simple app-based money lenders before their recent transitions to becoming digital-banks that offer other such services.

For example, in November, 2021, Blueprint Weekend learnt that NITDA received 40 petitions from the public about companies that abuse user data.

In reaction to this, NITDA in August imposed a N10 million ($24,000) fine on of such called Soko Lending Company, owners of sokoloan – an app launched in September 2018 that has over one million downloads.

NITDA, therefore, said it is worried about the harm caused by these money lenders, the reason for which it is teaming up with other agencies like the Federal Competition and Consumer Protection Council to enforce privacy rights in accordance with the Nigeria Data Protection Regulation (NDPR) enacted in 2019.

Therefore, as the 2019 National Privacy Week is being marked, it provides an ample opportunity for the issue to be brought to the front burner.

Emefiele’s warning, admonition

While lending his voice to the issue, the governor, Central Bank of Nigeria (CBN), Mr. Godwin Emefiele, said Nigerians should beware of illegal money lenders who, according to him, are known as loan sharks. He spoke recently at the end monetary policy committee meeting held in Abuja.

The CBN boss was of the view that those who collect loans from places other than microfinance banks or recognised banking institutions run a greater risk.

He added that ‘loan sharks’ offer loans at extremely high rate returns under strict terms of collection upon failure and in most cases they generally operate outside the code for financial institutions.

“There is no need for you to go to loan sharks for a loan. People normally go to loan sharks because they are desperate and can’t access the bank.

“We found out that those that are vulnerable are households who need money to do their businesses but they can’t access bank finance and as a result go to loan sharks who charge them way above or two times higher than the amount borrowed and expected to pay back in 90 days and if that doesn’t happen, they seize your house or bikes.

“We can only continue to advise that there is no need to go for loan sharks. The central bank has put in place the avenue through which you can raise your finance, like through the target credit facility or the SME loan that was set up through our microfinance banks.

“You don’t have to owe anybody; just go to the portal and fill the form, send your data and if it’s correct, you would be able to access loans,” Emefiele said.

He made it clear that several people have benefitted from the microfinance’ strategies to give out loans at affordable return rates, adding that CBN would go after loan shark perpetrators.

“We have a large number of people who have testimonials from the facilities we’ve made available and do not have to owe anybody.

“The bank is putting effort to stop loan sharks and when these people are found, they will be dealt with mercilessly.”

Respite

According to the National Cybersecurity Alliance, what has come to be known as

Data Privacy Week helps to spread awareness about online privacy and educates citizens on how to manage their personal information and keep it secure.

It stated that Data Privacy Week also encourages businesses to respect data and be more transparent about how they collect and use customer data.

To promote these goals, the National Cybersecurity Alliance says it would promote and encourage actions leading up to Data Privacy Week that would be observed in many countries.

“Everything you do online generates data. There’s data about your activities, behaviours and interests. There’s your personal data, like your social security and driver’s license numbers. There’s data about the physical you, like health data. It’s easy to feel a lack of control over the information collected about you. However, there are steps you can take to learn about the types of data you’re generating online and how it’s collected, shared and used.

“Consumers are becoming increasingly concerned with data privacy and companies are realising this and responding. We encourage consumers to be selective about who they choose to do businesses with and understand the value of their data,” it stated.

As part of its oversight functions, the House of Representatives recently unveiled plans to investigate the activities of online loan providers nationwide.

The resolution was passed sequel to the adoption of a motion sponsored by a Akin Alabi, which was on the need to curtail the excesses of online service providers.

Lawmakers’ angst

While leading the debate, Alabi observed that to cushion the impact of the Covid-19, a rising number of Nigerians have resorted to digital lenders to sort out urgent financial needs as, according to him, traditional financial institutions were not helping matters.

“Because of this lending platforms spring up here and there,” but several of such platforms operate outside the principles of lawful processing of personal data as required under the Data Protection Regulation and other relevant provisions.

Alabi said, “The House is also concerned that many online providers are exploiting the growing need for financial assistance to engage in unfair collection practices by subjecting Nigerians to situations where their contacts are besieged with unsolicited messages in a bid to force the borrowers to pay up.

“The House is disturbed that the online loan providers have resorted to a pesky habit of shaming as a tactic to get their customers to pay and taking actions that are tantamount to privacy violation, intimidation and harassment.

“The House is also disturbed that some online lenders operating in the country do not have a privacy notice while some privacy notice of those who have is often not comprehensive enough to explain how a user’s data is processed.

“The House is worried that the recovery agents for the lending firms are mostly unprofessional and often apply unethical methods including impersonating lawyers and security officers, in a bid to recover borrowed funds from defaulting clients.

“The House is cognisant that the Nigerian Data Protection Regulation was established due to the government’s recognition that information must be safeguarded, regulated and protected against atrocious breaches,” he noted.

Also, lending his voice, a lawmaker from Enugu state, Amadi Dennis, urged the House to thread the matter with caution, saying there is need for regulatory agencies that license the operators to ensure compliance with extant laws.

The House, therefore, tasked the CBN to make feasible regulations to curb the extremism of unscrupulous online loan providers in Nigeria.

The lawmakers also stressed the need for the government to put more stringent regulations in place to protect the interest of third party individuals from receiving unsolicited messages.

According to the House, there is the need for NITDA to ensure strict adherence to the Nigerian Data Protection Regulation by all online loan providers.

Hence, the House mandated its Joint Committees on Banking & Currency, Communications and Human Rights to investigate the matter and report back within two weeks for further legislative action.

Enter data mgt agency

In the meantime, President Muhammadu Buhari has approved the establishment of the Nigeria Data Protection Bureau to ensure compliance with the Nigeria Data Protection Regulation.

According to a statement signed by Uwa Suleiman, the spokesperson to the minister of communication and digital economy, Isah Pantani, the bureau would focus on data protection and privacy for the country.

“The successful implementation of the National Digital Economy Policy and Strategy (NDEPS) for a digital Nigeria has significantly increased the adoption of data platforms and accelerated the datafication of our society. This has increased the importance of having an institution that focuses on data protection and privacy.

“The Bureau will be responsible for consolidating the gains of the NDPR and supporting the process for the development of a primary legislation for data protection and privacy.”

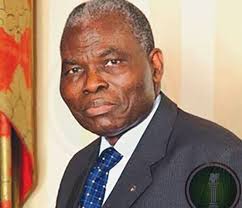

To that extent, the president approved the appointment of Dr. Vincent Olatunji to serve as the national commissioner/chief executive officer of the Centre.