By Benjamin Umuteme

Abuja

The Nigeria Sovereign Investment Authority (NSIA) has said it will invest in the Chapel Hill Denham Nigeria Infrastructure Debt Fund (NIDF).

The Fund is managed by Chapel Hill Denham Management Limited.

This proposed investment is consistent with NSIA’s mandate as the Authority continues to develop and explore opportunities to play a leading role in driving sustained economic development for the benefit of all Nigerians.

The NIDF is a Nigerian domiciled close-ended fund. It is the first and only domestic currency, listed infrastructure debt fund across Africa and is focused on mobilising domestic savings – particularly pension funds, life insurance companies, large corporates as well as family office groups – for investing in economically critical and financially viable infrastructure assets.

The fund supports traditional infrastructure sectors, primarily transport, power, renewable energy, utilities, energy infrastructure, logistics and other public-private-partnership type investments, with Naira long-dated senior debt. NIDF is able to support these projects with long-term financing and in the process, generates superiorrisk adjusted returns for its investors.

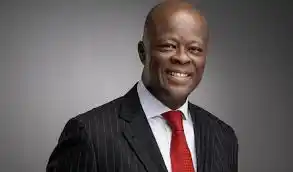

Commenting, Uche Orji, Chief Executive Officer and Managing Director of the NSIA said “We are pleased to support NIDF, as it is consistent with NSIA’s strategy of enabling Nigeria pension fund participation in infrastructure, makes available long-term Naira financing, and is led by a high-quality management team.We look forward to working with the NIDF team to ensure the fund grows through further institutional investor participation and access to high-quality investments.”

Bolaji Balogun, Chief Investment Officer of the NIDF and Chief Executive Officer of Chapel Hill Denham, said “Mobilisation of domestic currency sources for funding infrastructure is critical for Nigeria, in order to meaningfully bridge the existing infrastructure deficit. NIDF directs institutional investments into productive infrastructure assets, which have a positive development impact, through the multiplier effect on investments, economic growth and well-being of the population.

NIDF has the potential to mobilise a meaningful proportion of this requirement, by channelling the growing pension and insurance assets as well as other long-term pools of capital into infrastructure investment and financing”.

Philip Southwell, Chairman of the NIDF’s Investment Committee, said: “Historically, senior debt financing for infrastructure projects in Nigeria has been provided by commercial banks, financial institutions, export credit agencies and multilateral/bilateral investment agencies in US dollars with a substantial proportion in relatively short tenors. The NIDF changes that paradigm for Nigeria.By listing the NIDF on the FMDQ Exchange in July 2017, we have created liquidity in an asset class that is inherently illiquid, strengthened the domestic capital markets and enabled a wider range of investors to invest in infrastructure”.