Africa’s leading financial institution, the United Bank for Africa (UBA) Plc has announced its audited half year financial results for the half year ended June 30, 2021, showing impressive growth across all major income lines and performance indicators.

The pan African financial institution delivered a 33.4 per cent appreciation in its profit before tax which rose to N76.2 billion as at June 2021, up from the N57.1 billion recorded in the same period of 2020. This translated to an annualised Return on Average Equity (RoAE) of 17.5 per cent as against 14.4 per cent a year earlier. This feat was recorded despite the challenging business and economic environment that emerged from the slow pace of activities following the global lockdown occasioned by the Covid-19 pandemic.

The results submitted to the Nigerian Exchange Limited, showed that the group’s profit after tax stood at N60.6 billion, representing a significant rise by 36.3 per cent, compared with the N44.4 billion recorded in the half year of 2020

Similarly, gross earnings grew to N316 billion, which was a five per cent increase, from the N300.6 billion recorded as at June 2020.

According to the results, at June 30, 2021, the group’s total assets crossed the N8 trillion mark as it increased to N8.3 trillion, up from N7.7 trillion at the end of the 2020 financial year. Its customer deposit also crossed the N6 trillion mark, growing by 7.4 per cent to N6.1 trillion in the period under review, compared with N5.7 trillion as at December 2020.

Furthermore, the group’s Shareholders’ Funds remained robust at N752.5 billion, up from N724.1 billion in December 2020, reflecting its strong capacity for internal capital generation.

In line with the bank’s culture of paying both interim and final cash dividend, the Board of Directors of UBA declared an interim dividend of 20 kobo per share for every ordinary share of 50 kobo each, held by its shareholders.

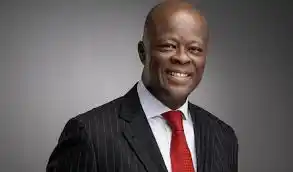

Commenting on the results, UBA’s Group Managing Director/Chief Executive Officer, Mr. Kennedy Uzoka, expressed delight over the bank’s performance in the first half of the year.

He added: “This has been a strong first half for us, as global economic recovery exceeded expectations, creating a positive rub-off on consumer and corporate confidence, savings and investment activities.